Empowering Your Pursuit of Business Life Happiness Success

GET THE LIBERTY ADVANTAGE

TALK TO AN AGENT

EXPERTISE

We’re experts in the industries we serve. We navigate complexities and deliver you the insights and information you need.

ONLINE TRAININGS AND HR PORTAL

Our online training tool has the ability to push training videos directly to your employees through our Learning Management System. The HR portal contains resources for today’s HR professionals, who often wear multiple hats.

RISK MITIGATION TOOLS

Claims inevitably happen to all businesses, large and small, especially in workers’ compensation when an experience modification factor involved keeping the costs of claims low helps keep premiums low in the long run. Conversely, on first-party claims we advocate on your behalf to make sure you receive every dollar you deserve.

LOSS CONTROL ANALYSIS

Having a repeatable loss prevention plan that can be applied as minimum acceptable standards across all franchisees keeps insurance costs low, especially if you are in a high-hazard industry. Our experience allows us to talk to the franchisor at the 10,000-foot level so consistency can be had on the ground.

SENSITIVITY TRAININGS AND MATERIALS

Your employees are exposed to a diverse range of members of the community, and they need to build interpersonal relationships with all of your clients.

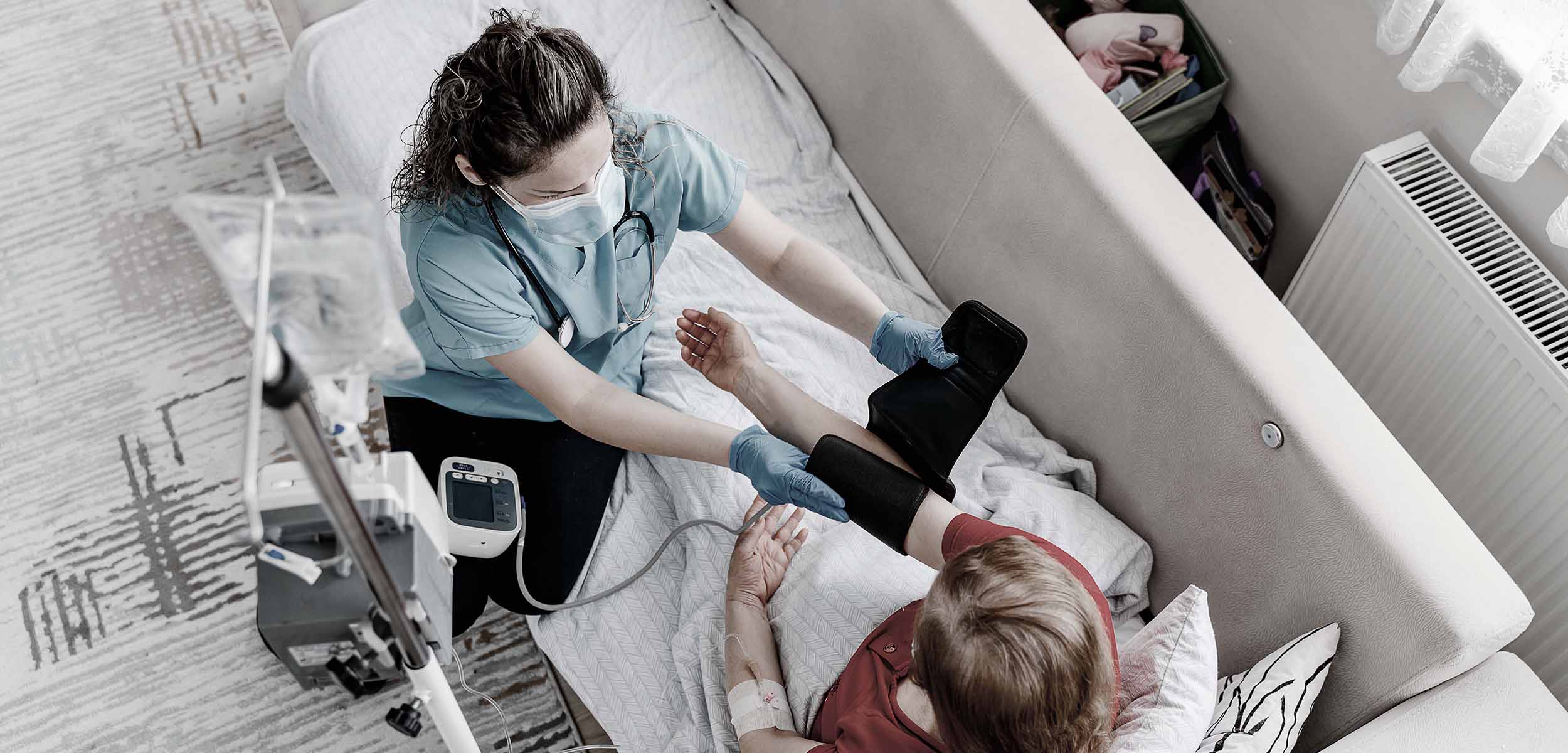

LIFT / TRANSFER AND INJURY PREVENTION

We know that lift transfer is the largest driver of severe claims in your industry. Proper training around this activity is critical to keep your experience mod low.

STATE-REQUIRED COVERAGE RECOMMENDATIONS

The margins in your industry are small and getting ever smaller. We have the markets available to keep you compliant while managing your costs so you can make investments in all required areas of your business.

PLAN DESIGN

Creative plans designs and alternative funding mechanisms can provide savings for many employers. Our seasoned consultants will dig deep and work with our clients to seek opportunities for financial savings.

CLAIMS UTILIZATION

For our self-funded clients, we offer software that houses millions of claim lives. Enabling us to accurately predict future claims. More importantly, the data allows us to address potential claim drivers before they become excessive.

EMPLOYEE BENEFIT EDUCATION

We understand that benefits are not benefits unless your employees are familiar with all you provide. Employee benefits are expensive, so we feel it is important to provide education and information on several fronts to assist your employees so that they can become familiar with your organization’s benefit program.

SELF-FUNDED OR LEVEL-FUNDED BENEFIT PROGRAMS (Medical, Dental, Vision)

Program lowers fixed costs, enabling claim savings for the plan to roll directly to the bottom line.

MEDICAL STOP LOSS COVERAGE

We partner with the largest managing underwriter, which allows us to obtain the most favorable rates and underwriting conditions for self-funded clients.

BUDGET / PREMIUM EQUIVALENT RATES

Our actuarial software tool enables us to prepare budget reports on behalf of the client. Health care premiums are often the #1 expense items outside of payroll. Staying on top of projected premium spend is import for running your business.

ICHRA – INDIVIDUAL COVERAGE HEALTH REIMBURSEMENT ARRANGEMENT

We have the technological solution that enables employers to fix their health benefit spend. As group health premiums continue to increase, this is becoming an attractive option.

ERISA DISCLOSURE

5500 preparation, summary plan descriptions, plan documents

ACA REPORTING

We assist you in understanding your obligations and sourcing options for required reporting.

HEALTH RISK CONSULTING

Our in-house wellness coordinator pulls resources from numerous sources to customize a wellness program that is right for your organization. Heathy employees are more productive and present, and they cost less in claims, which drives premiums lower.

HR HANDBOOK AND CONSULTATION

Liberty realizes that Complex and sensitive employee issues happen in every workplace. Having access to HR professionals and a comprehensive library for guidance is another Liberty Advantage Solution.

ANNUAL COMPLIANCE AUDITS

Liberty provides a comprehensive review to ensure our clients are compliant with DOL standards and filings, helping you avoid fines, penalties, and fees.

HEALTH CARE REFORM, ERISA, HIPAA, COBRA

Our in-house compliance expert is a valuable resource for our clients both large and small. We understand the complex laws are confusing and ever changing, which is why we provide assistance and guidance to our clients.

AGREED VALUE

You don’t want to be at the mercy of comparables for your vehicle at time of loss. Several of our carriers offer agreed value coverage, so you know what your car is worth and how much you will receive after a claim.

COLLECTOR CAR

You restored your car from the ground up and it’s your baby. Let’s make sure you have the specialty coverages to protect your vehicle in case of a loss. We have several markets that offer appraised value coverage, specialty parts sourcing experts, original parts coverage and more.

OEM PARTS

After a loss, you want your vehicle to retain as much value as possible. Allow us to endorse original equipment manufacturer parts coverage onto your policy. You’ll get original parts, not aftermarkets ones, after a loss and your vehicle’s value will remain intact.

PERSONAL AUTO

INSURANCE TO VALUE CALCULATIONS

In environments of high and low inflation, maintaining the proper insurance limits on your buildings is key. Insurance premiums are developed by taking an exposure times a rate. Adequate limits prevent you from being penalized in a loss or paying more in premiums.

SLIP, TRIP, FALL PREVENTION

If your facility has exposure to the general public, maintaining a safe walking environment free of hazards is critical to preventing slip/fall claims. When they do occur, having an effective CCTV camera system goes a long way to mitigating the value of a claim. Proper documents at the time of the accident, including a fully completed incident report, goes a long way too.

CYBER LIABILITY

The bad actors and cyber thieves are smart and cunning. Having a properly structured cyber policy covering first-party restoration/extortion expenses and a dedicated social engineering fraud endorsement is a must! It is now a matter of when, not if!

PRODUCT LIABILITY & MANUFACTURING E&O

Nuclear verdicts are changing rates in the market. We understand machine and job shops where your product ends up with various end uses. If your product/machine is part of an assembly line, considering E&O insurance is a must.

RTW PROGRAM IMPLEMENTATION

Getting your employees back to work when modified duty can be accommodated has been a proven long-term cost reducer. We understand each employer has a different approach. We can help you understand the restrictions and design a job either at your work or through a nonprofit arrangement.

WORKERS COMPENSATION AUDIT

The insurance company makes mistakes all the time, these mistakes can be costly when it comes to your Employees Workers Compensation codes. Our team members can review the state descriptions and help you avoid overpaying!

FORK TRUCK TRAINING

Although we use them everyday, these indispensable tools can cause severe injuries. We’ve had them knock of scissors lifts and severely injure coworkers coming around the corner. Annual safety training on their operations is a must!

ACTIVE SHOOTER TRAINING

Our Learning management system includes dozens of courses on various HR and Risk Management topics. In this day and age having your facility trained on what to do in an active shooter situation can save lives.

PROPER LIFTING TECHNIQUES

Soft-tissue injuries from lifting strains to backs and shoulders continue to be one of the top five drivers of severe claims.

VACATION HOME

Domestic travel to the sunny beaches along the eastern coast, gulf and western coast is ideal. You need an agent who can help you navigate this complex market and help you understand what to look for to best insure your home away from home.

LIFE INSURANCE

This provides financial compensation to your beneficiaries at the time of your death. Together we can evaluate the coverage needed for your family after you pass away so they will have financial security.

HOST LIABILITY

It’s such a joy to invite people into your home, but sometimes accidents happen. If you’re sued in a personal capacity, your liability coverage is what your policy will pay out for a settlement. This also includes the cost of defense. Let’s make sure your lifestyle and assets are protected by ensuring you have adequate liability coverage.

SERVICE LINE

Underground lines are covered up to a sublimit with many of our carriers for both pipe repair and excavation after a covered loss. Without this coverage, you may be left out of pocket to repair the sewer or other underground utility lines. Plus, this covers all your lines for a single annual fee rather than a separate monthly fee for each line through the utility companies.

RENTERS

Your belongings are your life when you rent. Don’t assume your landlord’s or parents’ policy will cover your belongings. Allow us to provide you coverage for your assets while renting.

AUTO INSURANCE

Don’t let a single moment define your financial life. Auto insurance isn’t just a state requirement, it’s a protection for the life you’ve built. We are here to listen to your needs and create an auto policy based on your driving habits and needs.

PERSONAL MULTI-LINE

BUILDER’S RISK AND INSTALLATION FLOATER

It’s never a problem until it’s a problem. Having a properly structured builder’s risk or installation floater will protect you when job-site materials go missing.

LADDER AND FALL SAFETY

Keep your employees safe by using the Liberty Solution Center to have material available for your company’s next tool box talk.

SCAFFOLDING AND FALL PROTECTION

Preventing serious injuries to employees is important to every employer, the last thing anyone wants is to have someone experience an injury at work that impacts their ability

to live a normal life.

EMPLOYEES AND RTW PROGRAM

Accidents happen. Mitigate the costs of those claims with an effective return-to-work program. Reducing the medical and indemnity payments associated with a Workers Compensation claim will ultimately reduce your premium through a lower experience modification factor.

OSHA RECORDABLE TRACKING PROGRAM

Maintain your OSHA 300 logs in the Liberty Solution Center via our complimentary online product. Don’t pay for separate tracking software when ours is included!

CONTRACT REVIEWS

Risk transfer is a real thing and will impact your ability to recover from a subcontractors or general’s insurance policy in the event of a claim. You may still need to sign the contract, but going in educated on the risk you are assuming is best practice.

SURETY BONDING

Having cost-effective capacity available for our contractors to successfully bid public jobs both large and small is important. Our bonding department works exclusively with our contracting clients actively bidding these projects.

Our Process EMPOWERING YOUR PURSUIT OF SUCCESS

We’ve created an approach marrying data, insights and our expertise to find custom solutions.

Our process helps uncover items you may not be thinking about now and determines how much of a risk they could become to you in the future should something go wrong. No matter what, we’ll continue to empower you in your pursuit of success.

Our Process

We’ve created an approach marrying data, insights and our expertise to find custom solutions.

Our decades of industry specific experience help us spot risk before it becomes a problem. But we don’t stop there. The Liberty Advantage ensures that we get to know the exact risks you or your business face.

We leverage the latest data and technology to help assess the risks you are facing. Our team of experts are constantly on the lookout for not just the liabilities that are most likely to impact you, but also for solutions that keep you protected.

Need Liberty Support Message.

There is no “one size fits all” solution to insurance. We work directly with you to help find the right policy and financing options to keep you protected.

We create true, ongoing partnerships with our clients. This helps ensure that if something goes wrong and you need to file a claim, we already have an intimate knowledge of how to best serve you.

Your insurance needs are unique. That’s why we develop coverage plans that are just as individualized as you are.

Our process helps uncover items you may not be thinking about now and determines how much of a risk they could become to you in the future should something go wrong. Count on the Liberty Advantage to keep you protected.

YOUR TEAM

We take the most experienced, talented and driven experts in the industry and put them directly with you. From your first meeting until the moment we are needed. Simply put, our top people are your people.

YOUR TEAM

Steve Pcsolar

Account Executive

Ronna Wasik

Receptionist

Megan Entwistle

Account Manager

Kris Ray-Dublin

Claims Analyst

Kiersten Sikora

Consultant

Kaylee Mateer

Lead Technical Assistant

Kathy Pastorius

Quality Risk Coordinator

Jenna Kolb

Executive Director of Commercial Operations

Gary Wobb

Senior Vice President

Erin Williams

Account Manager

Dylan Jenkins

Vice President

Dave Rawlings

Senior Vice President

Dan Destefano

Senior Executive Vice President

Cheryl Fichter

Account Manager

Beth Truax

Senior Account Manager

Becky Burek

Select Department Manager & Operations Trainer

Bailey Chishko

Account Manager

Armand Petito

Vice President

Amy McCloskey

Technical Assistant

Amber Mauric

Account Manager

Alex Guckes

Account Manager

Abram Addair

Account Manager

Jessica Entwistle

Head of Personal Insurance

Alaina TeSelle

Junior Account Manager & Digital Marketing Assistant

We take the most experienced, talented and driven experts in the industry and put them directly with you. From your first meeting until the moment we are needed. Simply put, our top people are your people. We take the most experienced, talented and driven experts in the industry and put them directly with you. From your first meeting until the moment we are needed. Simply put, our top people are your people.

YOUR TEAM

We take the most experienced, talented and driven experts in the industry and put them directly with you. From your first meeting until the moment we are needed. Simply put, our top people are your people.